salt tax deduction wikipedia

1 But they do it. Under United States tax law itemized deductions are eligible expenses that individual taxpayers can claim on federal income tax returns and which decrease their taxable income and is.

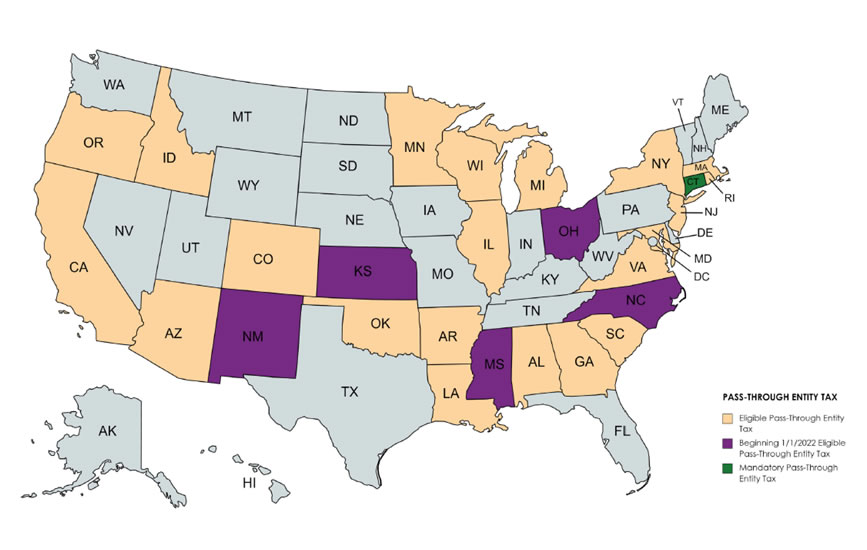

Ohio Enacts Salt Cap Workaround Effective 2022 Forvis

The most you are able to claim the SALT deduction for state and local.

. Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses particularly those incurred to produce additional income. Tax deductions and tax credits both lower the amount of money a person has to pay in taxes. Behind the decrease in itemizers and increase in taxpayers taking the standard deduction is the TCJAs near-doubling of the standard deduction which limits the value of.

Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse. The SALT deduction has been a part of our federal income tax since 1913. Tax deduction at source in India is a means of collecting tax on income dividends or asset sales by requiring the payer to deduct tax due before paying the balance to the payee.

This deduction is a below-the-line tax. Accordingly the taxpayers 2018 SALT deduction would still have been 10000 even if it had been figured based on the actual 6250 state and local income tax liability for 2018. This means you can deduct no more than.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. However this tax was greatly increased when the British East India Company began to establish its rule over provinces in. The Tax Cuts and Jobs Act.

If you take the standard deduction on your federal income tax return you cant write off the state and local taxes paid. Almost all 96 percent of the benef its of SALT cap repeal would go to the top quintile giving an average tax cut of 2640. The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to taxpayers who itemize their.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. 57 percent would benefit the top one percent a cut of. 52 rows The state and local tax deduction commonly called the SALT deduction is a federal deduction that allows you to deduct the amount you pay in taxes to your state or.

The Salt Tax Revolt took place in the Spanish province of Biscay Vizcaya between 1631 and 1634 and was rooted in an economic conflict concerning the price and ownership of salt. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a. A tax deduction is a way to reduce the amount of income that is subject to a tax.

The lawmakers simultaneously introduced legislation Thursday that would eliminate the 10000 SALT cap on federal tax returns that was imposed as part of the GOPs 15 trillion. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes. Tax deductions are a.

Taxation of salt has occurred in India since the earliest times.

Irs Clarification Salt Deductions Paid By A Partnership Or S Corporation Marcum Llp Accountants And Advisors

Is Median Household Income Based On Gross Wages Or Net Wages Quora

Alternative Minimum Tax Wikipedia

Eliminate The Salt Deduction Cap Get Your Questions Answered

Maryland S Salt Workaround Impacts And Planning Opportunities Buchanan Ingersoll Rooney Pc

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

When Prostitutes Service Secret Service Are They Tax Deductible

California S Workaround To The Federal Cap On State Tax Deductions Mgo

Massachusetts Enacts Pass Through Entity Tax Forvis

State And Local Tax Deductions Implications For Reform Aaf

Income Tax In The United States Wikiwand

How Raising The Salt Deduction Limit To 80 000 May Affect Your Taxes

2021 Year End State And Local Tax Planning Perspective Withum

Abby Crossing Dabbyquan Twitter

Deal For State And Local Tax Deduction Cap May Happen This Week

Tax Cuts And Jobs Act Of 2017 Wikipedia

The Pass Through Entity Tax A Salt Limitation Workaround Marcum Llp Accountants And Advisors

Nj Governor Signs New Laws That May Impact Your Business Or Non Profit Alloy Silverstein

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox